Shareholder Return/Dividends

Dividend Policy

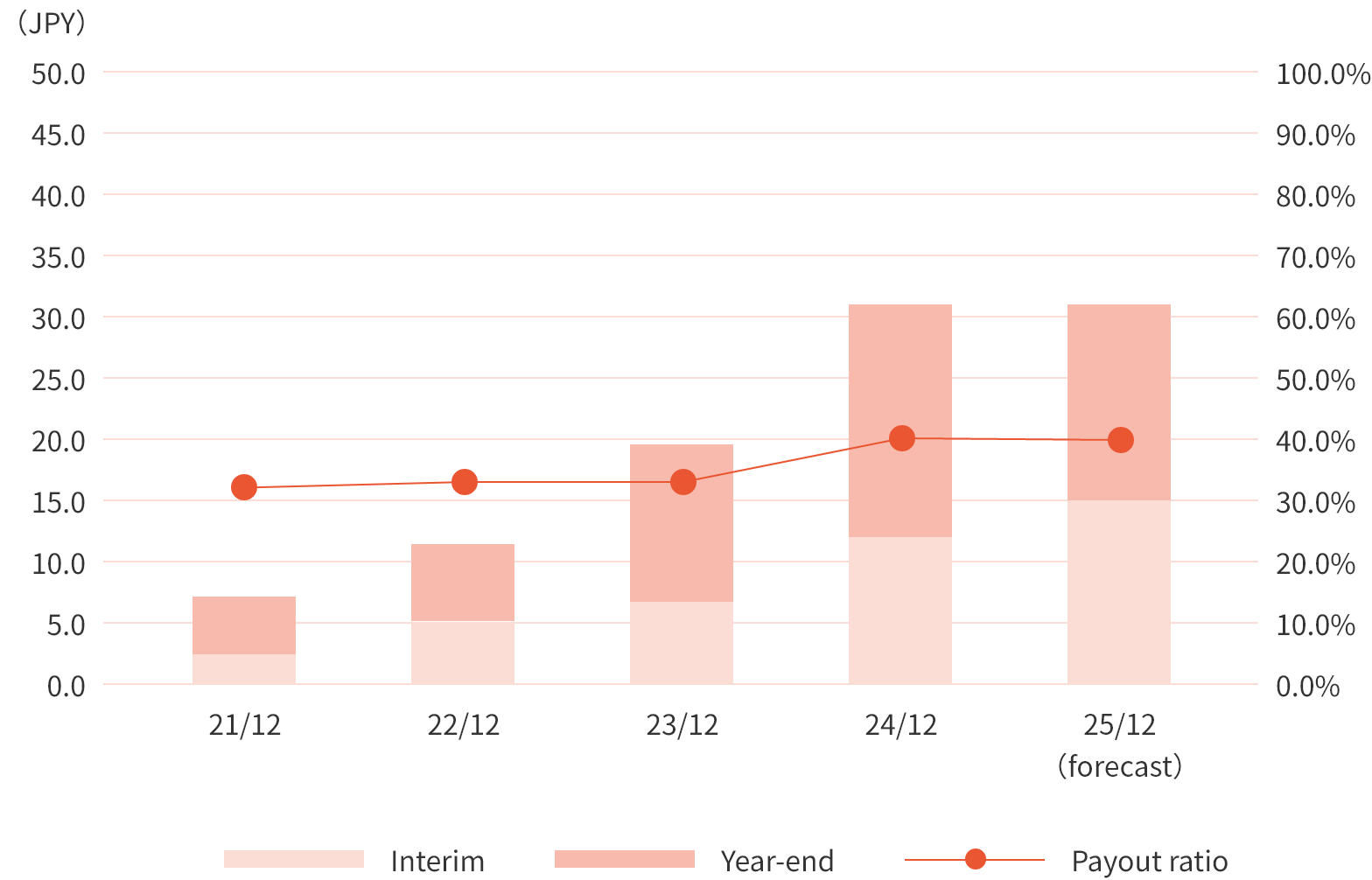

Returning profits to shareholders is an important policy, and under the “Medium-Term Corporate Strategy 2030” we have set a floor of 93 yen (31 yen after share split) per share, based on a 40% dividend payout ratio. Through growth in operating cash flow, the Company will achieve both investment in growth and stable dividends.

Changes in dividends and payout ratio

Dividends per share

(As of July 1, 2025)

per share(JPY)*2

The “Accounting Standard for Revenue Recognition” (ASBJ Statement No. 29, March 31, 2020) and others have been applied from the beginning of the fiscal year ended December 31, 2022, and agent fees, etc., which were previously recorded as selling, general and administrative expenses, are now deducted from net sales. Figures for the fiscal year ended December 31, 2021 and thereafter are after retroactive application of the said accounting standards.

*1:EPS=Basic earnings per share

*2: Kanro conducted a share split of common stock at a ratio of two shares for one share effective as of July 1, 2022 and a share split of common stock at a ratio of three share for one share effective as of July 1, 2025. Dividends per share, net assets per share, basic earnings per share, and total number of issued shares at the end of the period (not including treasury shares) are calculated on the assumption that the share split was conducted at the beginning of the fiscal year ended December 31, 2021.

*3: Dividends per share of FY2022 includes a commemorative dividend of 5 yen per share (commemorative dividend for 110th anniversary, pre-split basis).